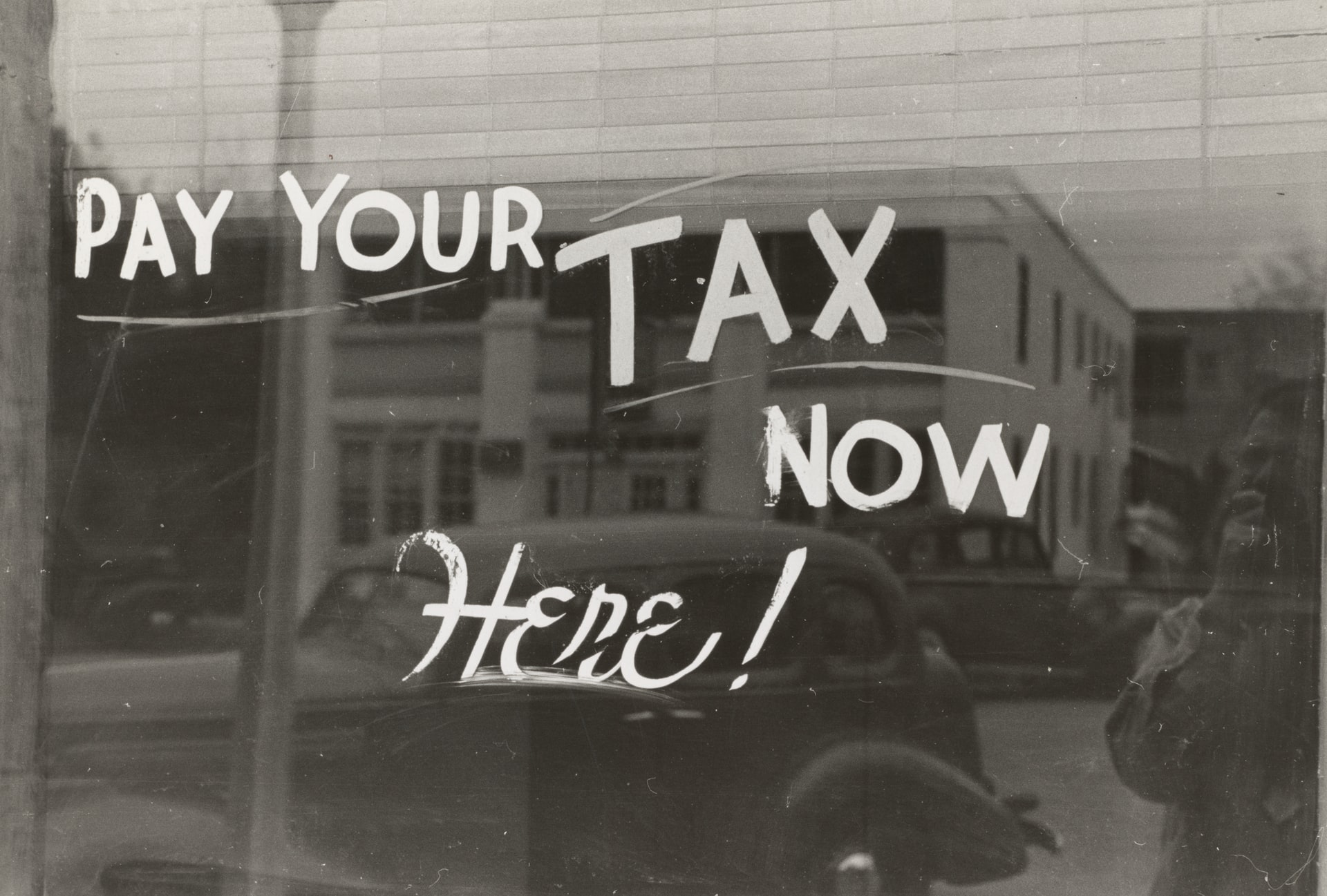

Federal and state governments have borrowed and spent extraordinary sums of money in response to the COVID-19 pandemic. With increased spending, government officials will need to look for ways to increase revenue in order to compensate and makeup for budgetary shortfalls. Unfortunately, when it comes to government, “increasing revenue” is another way of saying “increasing taxes.” In fact, budget shortfalls for 2020 have already caused cities like Nashville, TN to increase property taxes; the District of Columbia and the State of New Jersey to increase gasoline taxes; and the State of California is considering a new tax on wealth.

Given the budgetary shortfalls looming across the entire country, it might be a good time to start reviewing your future tax-mitigation strategy with your financial advisor and tax professional. To help you get the conversation started here are three tax-free income streams to consider.

Roth IRA

Roth IRA contributions are made with after-tax dollars, grow tax-deferred, and may eventually provide you tax-free income in retirement. In order for withdrawals to be taken tax-fee, the following conditions must be met.

You have had the Roth IRA for at least five years and the withdrawals are taken:

- At or after age 59 ½,

- Because you have a permanent disability,

- By a beneficiary or your estate after your passing, or

- To buy, build, or rebuild your first home (up to $10,000 can be withdrawn).

In other words, with a Roth IRA, you pay income tax today, most likely a lower rate than in the future, in order to fund a tax-free retirement account. This is especially important today as taxes are sure to increase throughout your lifetime. Additionally, Roth IRAs do not have Required Minimum Distributions (RMDs) and may continue growing in value beyond age 72 (the RMD age for traditional IRAs).

One thing to keep in mind is that income limits restrict who may contribute directly to a Roth IRA but you may be able to work around those restrictions with a Roth Conversion (also known as a “backdoor Roth”).

Municipal Bonds

State and local governments frequently issue bonds in order to supplement their tax revenues. The interest paid on municipal bonds is generally exempt from federal, state and local income taxes within the issuing state, allowing investors to receive a tax-free income stream for the duration of the bond. However it is important to note that most states will tax the interest earned on municipal bonds issued in other states.

Ex: Municipal bonds issued in California may provide a tax-free income stream to residents within California. A municipal bond issued by the state of Arizona would be taxed as ordinary income to a California state resident. Please consult your tax professional for your state’s specific tax laws.

Health Savings Account (HSA)

Health savings accounts (HSAs) let you save a portion of your income on a tax-deductible (Pre-tax) basis to pay for medical costs not covered by your insurance. The funds in an HSA grow tax-deferred and withdrawals for qualified medical expenses may be taken tax-free. However, it is important to note that withdrawals prior to age 65 for non-qualified medical expenses will be subject to income taxes and a 20% withdrawal penalty. While an HSA is intended to pay for your current medical expenses, you are not specifically required to take distributions or make medical payments from the account. In fact, you may choose to let the funds in your HSA grow indefinitely. One of the major advantages an HSA can provide is that it can be used as a second “IRA” account. Once you reach age 65, you can take withdrawals from your HSA without penalty for any reason. You will still owe income taxes on withdrawals used for non-medical expenses, but withdrawals for qualified medical expenses will always continue to be tax-free. Once you reach age 65, you can use your HSA as an additional tax-free income stream dedicated to your medical expenses or you can use the HSA to fund a long-term care insurance policy. Ultimately, an HSA allows you to minimize taxable withdrawals from other accounts during your retirement years.