On March 27, 2020 President Trump signed the Coronavirus Aide, Relief, and Economic Security Act (CARES Act) into law. The CARES Act has numerous provisions, including some that may directly impact you. The CARES Act includes a lot of information, but please don’t feel too overwhelmed as we have underlined and made bold some of the important points for you. For now, please take a look at the provisions which include the following:

Tax Filing and IRA Contribution Deadline

The deadline for filing ones individual 2019 income tax return has been

extended to July 15, 2020. This automatically moves the contribution deadline

for 2019 IRA contributions to July 15, 2020.

Required Minimum Distributions (RMD)

The CARES Act suspends RMDs for 2020. This includes RMDs for Inherited IRAs and

Inherited Roth IRAs.

*What is unclear at this point is if it will impact required distributions from non-qualified Inherited Annuities, so please stay tuned.*

Withdrawals from Qualified Retirement Plans and

IRAs and Plan Loans

The CARES Act provides tax relief for retirement plan and IRA

“coronavirus-related distributions” up to $100,000 taken by individuals on or

after January 1, 2020 and before December 31, 2020. The CARES Act permits

in-service distributions, provides an exception to the 10% early distribution

penalty, exempts the distribution from the mandatory 20% withholding applicable

to eligible rollover distributions, allows the individual to include income

attributable to the distribution over a three-year period, and allows for the re-contribution of the

distribution to a plan or IRA within three years.

The CARES Act provides that for plan loans made during the 180-day period beginning on the date of enactment and December 31, 2020 the maximum loan amount is increased from $50,000 or 50% of the vested account balance to $100,000 or 100% of the vested account balance. The due date for any repayment on a loan is delayed for one year (normally five years).

To be eligible for the withdrawal and loan relief, an individual must fall within one of the following categories:

1. The individual is diagnosed with COVID-19 by a test approved by the Centers for Disease Control and Prevention;

2. The individual’s spouse or dependent is diagnosed with COVID-19; or

3. The individual experiences adverse financial consequences as a result of being quarantined, being furloughed or laid off or having work hours reduced due to COVID-19, being unable to work due to lack of child care due to COVID-19, closing or reducing hours of a business owned or operated by the individual due to COVID-19, or other factors as determined by the Secretary of the Treasury.

Plan administrators may rely on an employee’s certification that the employee meets these requirements.

Individual Charity-Related Provisions

The CARES Act allows for an above-the-line deduction up to $300 for cash

contributions to certain charities for those who do not itemize deductions.

Also, the Act increases the limitations on deductions for “qualified

contributions” by individuals who itemize by suspending the 50% of AGI

limitation, meaning up to 100% of AGI may be claimed as a charitable itemized

income tax deduction. A “qualified contribution” is a contribution paid in cash

during calendar year 2020 to an organization described in section 170(b)(1)(A)

and the taxpayer has elected the application of this section with respect to

such contribution. A “qualified contribution” does not include a contribution

to an organization described in section 509(a)(3) [ a supporting organization

in the non-profit space that supports other exempt organizations] or to a donor

advised fund.

Student Loan Provisions

For federal student loans, the Act suspends student loan payments

(principal and interest) through September 30, 2020 without penalty to the

borrower. No interest will accrue on these loans during this suspension

period.

In addition, employers may provide a student loan repayment benefit to employees on a tax-free basis. Under the provision, an employer may contribute up to $5,250 annually toward an employee’s student loans, and such payment would be excluded from the employee’s income. The $5,250 cap applies to both the new student loan repayment benefit as well as other educational assistance (e.g., tuition, fees, books) provided by the employer under current law. The provision applies to any student loan payments made by an employer on behalf of an employee after the date of enactment and before January 1, 2021.

Assistance for American Workers, Families and

Businesses

All U.S. residents with adjusted gross income up to $75,000 ($150,000 married),

who are not a dependent of another taxpayer and have a work eligible social

security number, are eligible for a full $1,200 “rebate,” $2,400 married. In

addition, they are eligible for an additional $500 per child. This is true even

for those who have no income, as well as those whose income comes

entirely from non-taxable means-tested benefit programs, such as SSI benefits.

Estates and trusts are not eligible for this rebate. The

rebates are being treated as advance refunds of a 2020 tax credit and taxpayers

will reduce the amount of the credit available on their 2020 tax return by the

amount of the advance refund payment they receive.

For the vast majority of Americans, no action on their part will be required in order to receive a rebate check as the IRS will use a taxpayer’s 2019 tax return if filed, or in the alternative their 2018 return. This includes many low-income individuals who file a tax return in order to take advantage of the refundable Earned Income Tax Credit and Child Tax Credit.

The rebate amount is reduced by $5 for each $100 that a taxpayer’s income exceeds the phase-out threshold. The amount is completely phased-out for single filers with incomes exceeding $99,000, $146,500 for head of household filers with one child, and $198,000 for joint filers with no children.

Business Tax Relief Provisions

Charitable Contributions by Corporations: Contributions

cannot exceed the excess of 25% of the business’ taxable income, which was

increased from 10% under prior law.

Employee Retention Credit: The bill creates a refundable payroll tax credit for 50 percent of wages paid by employers to employees during the COVDI-19 crisis. The credit is available to employers whose (1) operations were fully or partially suspended, due to a COVID-19-related shut-down order, or (2) gross receipts declined by more than 50 percent when compared to the same quarter in the prior year.

The credit is based on qualified wages paid to the employee. For employers with greater than 100 full-time employees, qualified wages are wages paid to employees when they are not providing services due to the COVID-19-related circumstances described above. For eligible employers with 100 or fewer full-time employees, all employee wages qualify for the credit, whether the employer is open for business or subject to a shut-down order. The credit is provided for the first $10,000 of compensation, including health benefits, paid to an eligible employee. The credit is provided for wages paid or incurred from March 13, 2020 through December 31, 2020.

Delay of Employer Payroll Taxes: Employers generally are responsible for paying a 6.2-percent Social Security tax on employee wages, and the bill allows employers and self-employed individuals to defer payment of the employer share of the Social Security tax they otherwise are responsible for paying to the federal government with respect to their employees. The provision requires that the deferred employment tax be paid over the following two years, with half of the amount required to be paid by December 31, 2021 and the other half by December 31, 2022.

Temporary Increase in Business Interest Deduction: The bill temporarily increases the amount of interest expense businesses are allowed to deduct on their tax returns, by increasing the 30-percent limitation to 50 percent of taxable income (with adjustments) for 2019 and 2020.

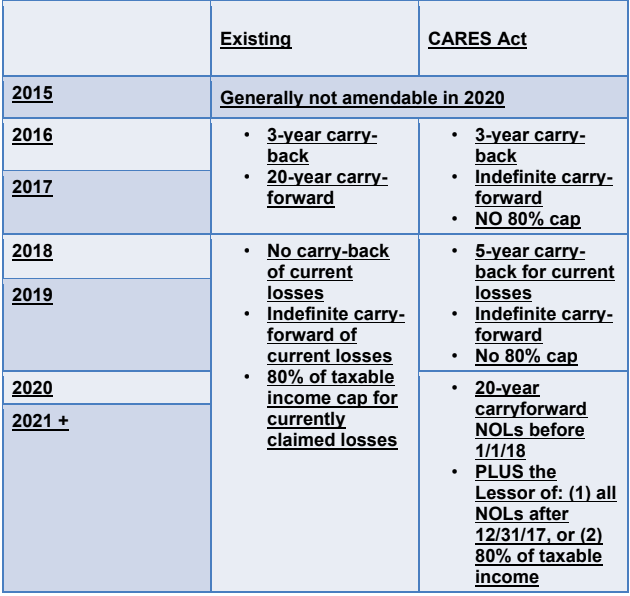

Treatment of Net Operating Losses (NOL): THIS WILL BE HUGE FOR BUSINESSES WITH NET OPERATING LOSSES The Tax Cuts and Jobs Act of 2017 significantly pared back the ability of businesses to carry forward/carry back Net Operating Losses. This was widely criticized at the time by some experts because NOLs had traditionally been used as a tool to provide tax relief when a business loses money.

Prior to the implementation of the Tax Cuts and Jobs Act, the Service allowed businesses to carry net operating losses (NOL) forward 20 years to net against future profits or backwards two years for an immediate refund of previous taxes paid. The Tax Cuts and Jobs Act eliminated the two-year net operating loss (NOLs) carry-back provision and allowed for an indefinite NOL carry-forward period. The CARES Act substantially liberalizes the NOL rules as set out in the attached chart.

Keeping American Workers Employed and Paid Act

One of the important cornerstones of the CARES Act is what is described in the

bill as the “Paycheck Protection Program.” Congress understands that the

majority of jobs in the American economy are generated by small to mid-size

businesses, and the CARES Act seeks to shore up payroll in those businesses by

leveraging the Small Business Administration’s Section 7(a) loan program

because it’s the primary program for providing financial assistance to small

businesses.

The CARES Act increases the maximum 7(a) loan amount to $10 million and expands the allowable uses of 7(a) loans to include “payroll support,” which includes paid sick or medical leave, employee salaries, mortgage payments, insurance premiums and any other debt obligations.

Under the CARES Act, the loan period for this program starts on February 15, 2020, and ends on June 30, 2020. The program generally only covers businesses with fewer than 500 employees.

To determine whether a business is eligible for this program, the CARES Act require lenders to ascertain: (1) whether a business was operational on February 15, 2020, and (2) whether the business had employees to whom it paid salaries and payroll taxes, or paid independent contractors, and (3) whether the business was substantially impacted by COVID-19. The legislation also gives more authority to lenders regarding eligibility determinations without having to run those determinations through the normal SBA approval channels.

Business eligible for the expanded 7(a) loans under the CARES Act include small businesses, nonprofits and veterans organizations with 500 or fewer employees. During the covered period, individuals who operate under a sole proprietorship or as an independent contractor and eligible self-employed individuals shall be eligible to receive a covered loan.

The CARES Act says that the allowable uses of 7(a) loans include salary, wages and commissions, tips, paid leave, health-care payments and retirement benefit payments. It’s important to note that allowable payroll costs do not include compensation to an individual employee in excess of an annual salary of $100,000 as prorated for the covered period. Qualified sick leave or family leave wages for which a credit is allowed under the Families First Corona-virus Response Act are not included in the allowable uses. It also does not include any compensation of an employee whose principal place of residence is outside of the United States.

One of the most important aspects of the CARES Act is that the 7(a) loans are non-recourse, except if the proceeds are used for an unauthorized purpose. In addition, no personal guarantee or collateral are required. That said, “Good Faith” certification is required and certification has the following elements:

• The current uncertainty makes the loan necessary to support ongoing

operations;

• The funds will be used to retain works and maintain payroll or make mortgage

payments, lease payments, and utility payments;

• There are no duplicate amounts.

The terms of these loans are as follows:

• Interest Rate: During the covered period, a covered loan shall bear an

interest rate not to exceed 4 percent

• Payment Deferment: 6-12 month of deferment including principal, interest and

fees

• Origination Fees: Lender reimbursed by the SBA

One of the most important aspects of the program is the way in which loan principal can be forgiven. Under the terms of the legislation, principal can be forgiven in an amount equal to the following costs incurred during the covered period of February 15, 2020 through June 30, 2020:

• Payroll costs

• Mortgage interest

• Rent

• Utilities

Any amounts forgiven will be reduced proportionally by any reduction in the number

of employees retained compared to the prior year and reduced by the reduction

in pay of any employee beyond 25 percent of their prior year compensation.

Borrowers that re-hire workers previously laid off will not be penalized for

having a reduced payroll at the beginning of the period. Most importantly,

indebtedness cancelled will not be included in the borrower’s taxable

income.

There are a lot of details to be mindful of

within the CARES Act, some of which may directly impact you. Remember, we are

here as a resource for you and look forward to continuing to provide you the

support needed during these uncertain times. Please feel free to contact

us by phone at (310) 557-1515 or by email at info@paragonfinancialpartners.com.